when are property taxes due in madison county illinois

You are about to pay your Madison County Property Taxes. Posted in Local Business Headlines.

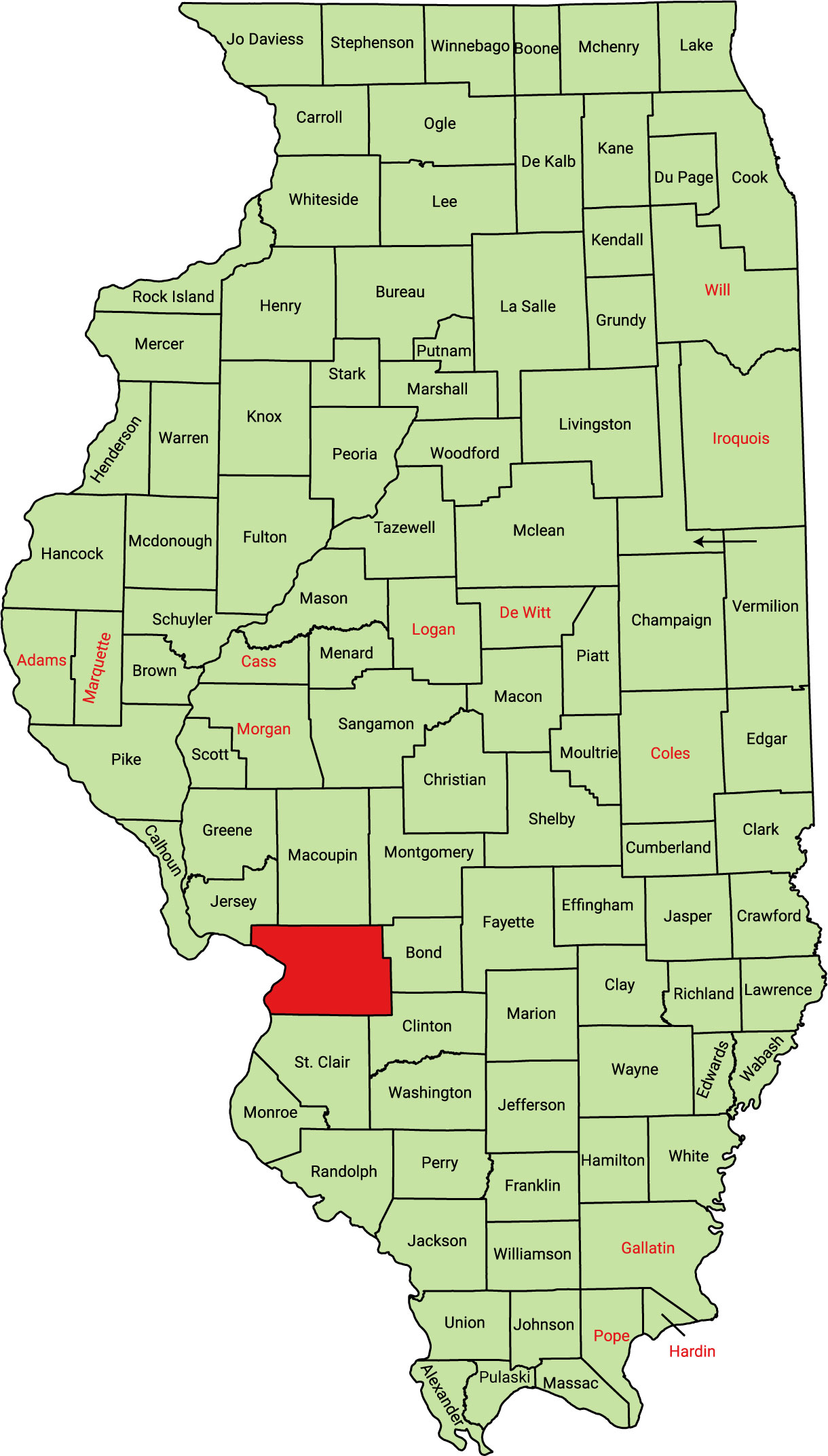

New Census Release 81 Of Illinois 102 Counties Lost Population In 2021 Cook County Lost The 3rd Most Nationwide Madison St Clair Record

The median property tax on a 12260000 house is 212098 in Illinois.

. For more information please visit Madison Countys Chief County Assessment Office and Treasurer or look up this propertys current tax situation. All other counties offer only two. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes.

EDWARDSVILLE Madison County Treasurer Chris Slusser is reminding taxpayers that the third installment of their tax bill is. Property tax due date approaching in Madison County Sep 28 2017 Sep 28 2017 Updated Sep 9 2020. Pay your Madison County Illinois property tax bills online using this service.

LovingLifePhotography Madison County Treasurer Chris Slusser said property owners should be receiving tax bills soon with the first installment coming due July 8. - CreditDebit Cards - 25 200 minimum - E-Checks - 150 per. The median property tax also known as real estate tax in Madison County is 214400 per year based on a median home value of 12260000 and a median effective property tax rate of 175 of property value.

Madison County collects on average 175 of a propertys assessed fair market value as property tax. When are taxes due in Madison County. The median property tax on a 12260000 house is 128730 in the United States.

173 of home value. 618 692-6270 Appeals Call the Madison County Board of Review at 618 692-6210 Tax rates or Tax redemption - Call the Madison County Clerk at 618 692-6290 Tax bills. Madison County Property taxes are paid in four installments.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. The exact due date is mentioned on your tax bill. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600.

Treasurers Office Suite 125 Edwardsville IL 62025. Cook County and some other counties use this. Box 729 Edwardsville IL 62025.

For other questions about. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Your taxes are not paid until funds settle into our bank account.

These taxing units include cities county school and. Madison County Administration Building 157 N. Madison County Treasurer PO.

Illinois 140 lanes to be restricted in Hamel area. LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at 430 pm. Exemptions or Appeals - Call the Madison Chief County Assessment Office at.

Included on the front page of this years tax bill will. Madison County Treasurers Office 157 N. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

Tax Rates and Tax Levy. Madison County IL real estate homeowners will receive their property tax bills in the mail soon in Southern Illinois near Belleville IL. Property Tax Reform Report.

County boards may adopt an accelerated billing method by resolution or ordinance. Real Estate Tax Frequently. Visit one of the nearly 100 collector banks and credit unions across Madison County.

The first installment for property taxes will be due on July 9 however for those struggling financially late penalties will be waived as long as the payment is received by September 9. In person from 830 am. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year.

And is non-refundable pursuant to Illinois law. The Treasurers Office will continue rolling out paperless delivery of tax bills or e-notice this year. Lane restrictions start on Illinois 159 in Madison County.

Madison County has one of the highest median property taxes in the United States and is ranked 388th of the 3143 counties in order of median property taxes. Madison County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. The median property tax on a 12260000 house is 214550 in Madison County.

Main Street Suite 125 Edwardsville IL 62025. Property valuation - Call your Township Assessor. In most counties property taxes are paid in two installments usually June 1 and September 1.

The median property tax on a 12260000 house is 128730 in the United States. However for those struggling financially late penalties will be waived as long as the. Madison County is one of only two counties in the state that offers taxpayers four installments to pay real estate taxes.

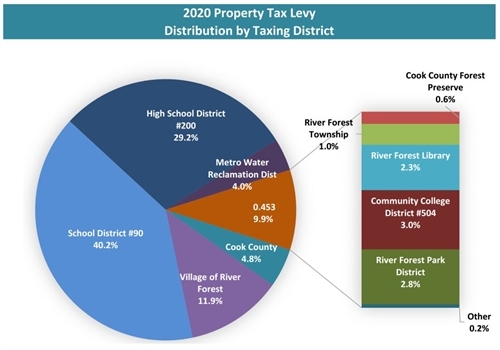

Madison County Auditor Financial Reports. Each year taxpayers receive a bill which includes information indicating exactly where their tax dollars are spent upcoming due dates and available payment options. Still property owners generally pay a single consolidated tax levy from the county.

Property tax due dates for 2019 taxes payable in 2020. Tax amount varies by county. Welcome to Madison County Illinois.

Madison County Treasurer Chris Slusser announced Tuesday that he plans to offer a two-month grace period for the first property tax payment in order to assist those struggling financially during the COVID-19 pandemic. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600. The first installment is due in July the second is in September the third in October and the last in December.

A reassessed value is then multiplied times a composite rate from all taxing entities together to set tax due. You are about to pay your Madison County Property Taxes. The first installment for property taxes will be due July 9.

Illinois gives real estate taxation power to thousands of community-based public entities.

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

St Clair County Property Tax Inquiry

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

North Central Illinois Economic Development Corporation Property Taxes

Delinquent Property Taxes Mcco